Lodge REITs: Selecting A Winner

martince2

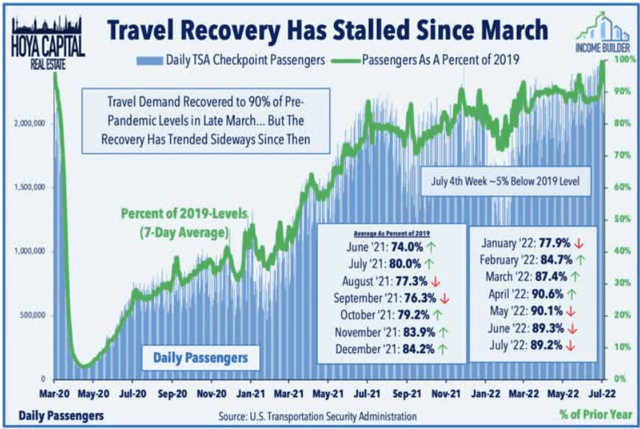

COVID hit Lodge REITs additional exhausting, however this yr has seen a substantial amount of leisure journey inside the US Information from the Transportation Security Administration reveals that journey passengers, as a share of 2019 ranges, reached basically 100% in July of this yr, after diving to close zero in April 2020.

Hoya Capital Earnings Builder

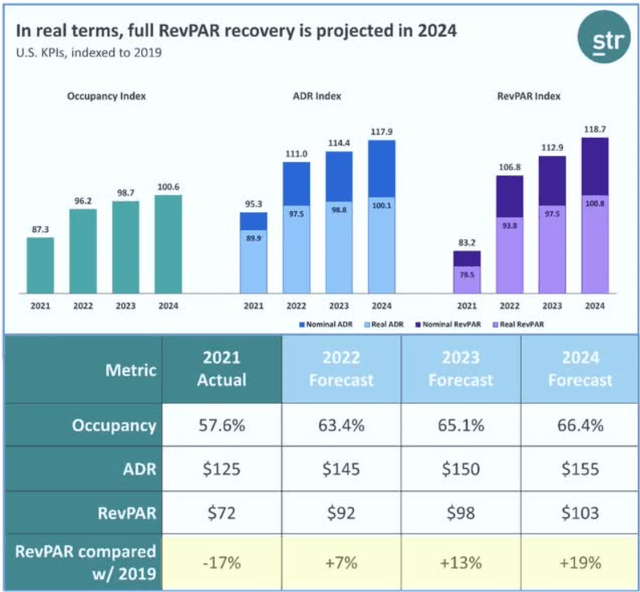

Based on Hoya Capital’s analysis, resort occupancy is again to 96% of the 2019 fee, whereas ADR (common every day room fee) is up 11% and RevPAR (income per out there room) is up 7%. Nonetheless, when inflation is taken into consideration, ADR is down about 2.5% and RevPAR is down about 6.2% since 2019. All three metrics (Occupancy, ADR, and RevPAR) are anticipated to be absolutely recovered to pre-pandemic ranges in actual phrases by 2024.

Hoya Capital Earnings Builder

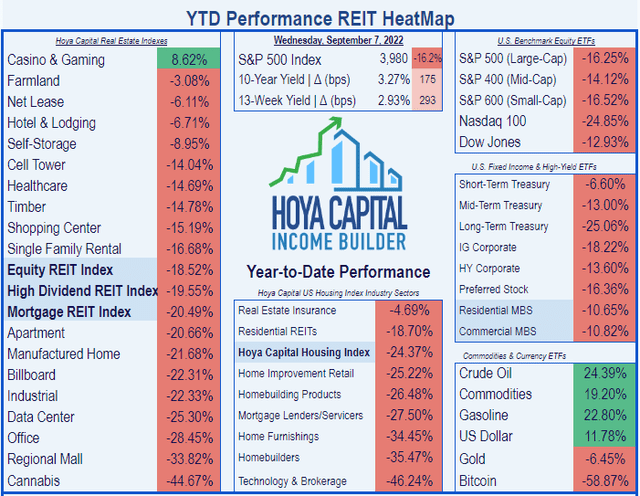

Consequently, Lodge REITs are the fourth-best performing REIT sector of 2022, with a mean complete return of (-6.71)%, in comparison with the Fairness REIT Index mark of (-18.52)%.

Hoya Capital Earnings Builder

The forecast for earnings development is excellent, all throughout the Lodge REIT sector.

So the query is, if you’re focused on beginning or rising a place in a resort REIT, which firm? This text zeroes in on the one Lodge REIT greatest positioned to reward traders over the following 12 months.

First Criterion: Stability Sheet

There are 15 US Lodge REITs. Since a strong stability sheet is the required basis of any sturdy funding, let us take a look at how these 15 firms are positioned for liquidity and debt, so as by market cap.

| REIT Lodges | Liquidity | Debt Ratio | Debt/EBITDA | Bond |

| Hosted Lodges & Resorts (HST) | 2.29 | 32% | 3.4 | BB+ |

| Ryman Hospitality (RHP) | 1.00 | 38% | 6.9 | B |

| Apple Hospitality (APLE) | 3.07 | 30% | 4.0 | — |

| Park Lodges (PK) | 1.81 | 57% | 10.6 | B |

| Pebblebrook Lodge (PEB) | 1.95 | 43% | 15.0 | — |

| Sunstone Lodge Traders (SHO) | 3.14 | 19% | 2.5 | — |

| RLJ Lodging (RLJ) | 1.95 | 56% | 7.5 | B+ |

| DiamondRock Hospitality (DRH) | 2.00 | 36% | 8.0 | — |

| Xenia Lodges (XHR) | 1.90 | 49% | 7.0 | B |

| Service Properties Belief (SVC) | 1.21 | 93% | 14.9 | B+ |

| Summit Lodge (INN) | 1.45 | 44% | 8.0 | — |

| Chatham Lodging (CLDT) | 2.41 | 46% | 9.0 | — |

| Hersha Hospitality (HT) | 1.44 | 62% | 9.0 | — |

| Braemar Lodges (BHR) | 1.43 | 89% | 11.5 | — |

| Ashford Hospitality (AHT) | 0.98 | 102% | 15.5 | — |

| Sotherly Lodges (SOHO) | 1.13 | 73% | 18.7 | — |

| InnSuites Hospitality (IHT) | 1.60 | 29% | — | — |

| REIT common resort | 1.81 | 41% | 9.5 | — |

| Total REIT common | 1.90 | 25% | 6.4 | — |

Supply: Hoya Capital Earnings Builder and TD Ameritrade

Within the desk above, values shaded in inexperienced are higher than each the Lodge REIT common and the general REIT common. Values shaded in yellow lie between the Lodge REIT common and the general REIT common. Values shaded in purple are under each averages.

As you may see from the underside two rows, the Lodge REIT sector is in worse form than the REIT sector total, with liquidity decrease and debt considerably increased.

There are lots of distressed stability sheets on this sector. Since we’re searching for the most effective Lodge REIT to spend money on, we are able to safely remove each firm whose Liquidity Ratio, Debt Ratio, or Debt/EBITDA is worse than the Lodge REIT common. That features each firm with any purple in its row of values. This eliminates all however 4 candidates: HST, APLE, SHO, and DRH.

This isn’t to say that not one of the different Lodge REITs may make you some cash as an investor. For instance, Sotherly Lodges (SOHO) was just lately designated by Zacks as a Robust Purchase. It is simply that with stability sheets that weak, they’re too huge a danger for my style.

Second Criterion: Funds From Operations

Wholesome firms do an excellent job of steadily rising revenues, that are greatest measured within the REIT world by FFO (Funds From Operations) per share. Let’s have a look at how our 4 candidates are doing in that regard.

| ticker | 3-year FFO Development | 5-year FFO Development | * 2022 FFO Development | * 2023 FFO Development |

| HST | ( -2.1)% | ( -0.3)% | 174% | 7.2% |

| APPLE | ( -3.2)% | ( -3.1)% | 58% | 13.6% |

| SHO | (-11.3)% | ( -8.0)% | 1750% | 33.8% |

| DRH | ( -6.1)% | ( -2.5)% | 633% | 17.0% |

| REIT common resort | (-6.4)% | (-15.0)% | 888% | 29.9% |

Supply: Hoya Capital Earnings Builder

*Projected

The trailing 3-year and 5-year FFO development numbers present that every one 4 of our candidates are outperforming the Lodge REIT common, which nonetheless hasn’t recovered to its pre-pandemic ranges. However all 4 considerably lag the general REIT averages of 9.1% and seven.8%, respectively. The exception is SHO, which is outperforming Lodges on 5-year development, however underperforming on 3-year development. Thus, Sunstone has been slightly slower to get better from COVID than the opposite three candidates.

The projected development figures for 2022 are gaudy. That’s largely as a result of most Lodge REITs simply returned to optimistic FFO final yr, so the comparables are extraordinarily straightforward. Thus, the projected 2022 Lodge REIT common FFO of $1.58 per share appears nice, in comparison with 2021’s common of simply $0.16. (Wow! that is an 887.5% improve! See what I imply?)

SHO appears nice on this yr’s projected FFO development column, exactly as a result of it was the slowest of the 4 candidates to return to optimistic FFO. By the identical token, APLE’s projected development of 58% appears anemic alongside the others’ triple-digit charges, however that’s as a result of APLE emerged sooner and stronger than the others, so its comparables are tougher.

Probably the most significant and eye-opening determine on this desk is the Lodge REIT sector’s projected common FFO development per share for 2023: a whopping 29.9%. Of our 4 candidates, solely SHO outpaces the pack on that metric. The others lag the projected common, exactly as a result of they’ve emerged sooner and stronger than the others.

All 4 of our candidates are projected to develop at wholesome charges.

Dividend metrics

That is the place we begin to see some separation. Itemizing our 4 candidates once more so as by market cap, a transparent favourite emerges.

| Firm | Div. Yield | 3-yr Div. Development | Div. Rating | Payout | Div. Security |

| HST | 2.72% | (-18.9)% | 1.45 | 30% | A |

| APPLE | 5.29% | (-11.2)% | 3.70 | 50% | A+ |

| SHO | 0.00% | (-33.0)% | 0.00 | 10% | — |

| DRH | 0.00% | (-33.0)% | 0.00 | 10% | — |

| REIT motels avg | 1.71% | (-26.3)% | 0.68 | 17% | A |

| REITs total | 3.38% | 6.2% | 4.05 | 59% | C |

Supply: Hoya Capital Earnings Builder, TD Ameritrade, In search of Alpha Premium

Dividend Rating initiatives the Yield three years from now, on shares purchased immediately, assuming the Dividend Development fee stays unchanged.

As you may see, APLE far outshines the opposite candidates in present Yield, and in reality, APLE is paying effectively above the REIT common, at 5.29%. Each firm within the Lodge sector eradicated its dividend throughout the COVID sell-off. APLE was the primary to revive its dividend. So when dividend development fee is taken into consideration within the Dividend Rating, APLE emerges just a bit under the REIT common, at 3.70, however far forward of second-place HST at 1.45.

Valuation metrics

Let’s record our candidates so as by dividend rating now, and have a look at valuation.

| Firm | Div. Rating | Value/FFO ’22 | Premium to NAV |

| APPLE | 3.70 | 10.4 | (-16.5)% |

| HST | 1.45 | 9.9 | (-23.3)% |

| SHO | 0.00 | 13.9 | (-14.6)% |

| DRH | 0.00 | 9.1 | (-190)% |

| REIT common resort | 0.68 | 10.2 | (-22.4)% |

| Total REIT common | 4.05 | 19.5 | (-5.0)% |

Supply: Hoya Capital Earnings Builder, TD Ameritrade, and creator calculations

The common Lodge REIT these days is “discount” priced at 10.2 instances FFO for 2022, barely over half the Value/FFO ’22 of the common REIT. Our 4 candidates are clustered close to the Lodge REIT common, with SHO on the excessive facet at 13.9x, and DRH on the low finish at 9.1. The distinction is sufficient to drop SHO to fourth place, however does not warrant any change within the first and second decisions. Solely Host Lodges (HST) trades at a reduction larger than the Lodge REIT common, and simply barely.

Market cap “Candy Spot”

Analysis by Hoya Capital signifies that the scale of a REIT exerts an actual affect on its complete return. The optimum dimension is “higher mid-cap,” from $4 – $10 billion. That is the Candy Spot. Subsequent greatest is massive cap, then “decrease mid-cap,” from $1.4 – $4 billion. Small cap REITs convey up the rear.

Right here is how our 4 candidates stack up on this key issue.

| Firm | Market Cap |

| Hosted Lodges & Resorts (HST) | $12.6 B |

| Apple Hospitality (APLE) | $3.6 B |

| Sunstone Lodge Traders (SHO) | $2.4 B |

| DiamondRock Hospitality (DRH) | $1.9 B |

Supply: TD Ameritrade

Of the 4, APLE is the closest to the Candy Spot, at $3.6 billion. The following most favorable spot is held by HST, at $12.6 billion.

Dialogue

That is sort of a no brainer. As a result of practically all Lodge REITs pay very low dividends, investing in any of them besides APLE is a price play. Traders aren’t fairly as yield-crazy as they had been earlier within the yr, and the true value of cash has come down some. So the atmosphere for development investing is healthier than it was in January, but it surely nonetheless is extra of a price investor’s atmosphere. From a development standpoint, it’s tough to establish a frontrunner within the pack. Nonetheless, from a price standpoint, there is no such thing as a contest, as a result of one firm boasts a vastly superior dividend.

And the winner is . . .

The Lodge REIT that emerged first and strongest from the pandemic, with a robust runway of FFO development, the primary to revive its dividend, and the one one which pays an above-REIT-average Yield:

Apple Hospitality REIT