Playa Motels & Resorts: Resiliency Regardless of Inflationary Pressures

Thomas Barwick/DigitalVision by way of Getty Photographs

Funding Thesis: Whereas I take the view that the inventory would possibly see some draw back forward – the inventory might see a big rebound subsequent yr if gross sales and bookings stay resilient.

In a earlier article again in July, I made the argument that Playa Motels & Resorts (NASDAQ:PLYA) has seen encouraging RevPAR progress throughout its portfolio, and is in a good money place to deal with a possible slowdown in income progress.

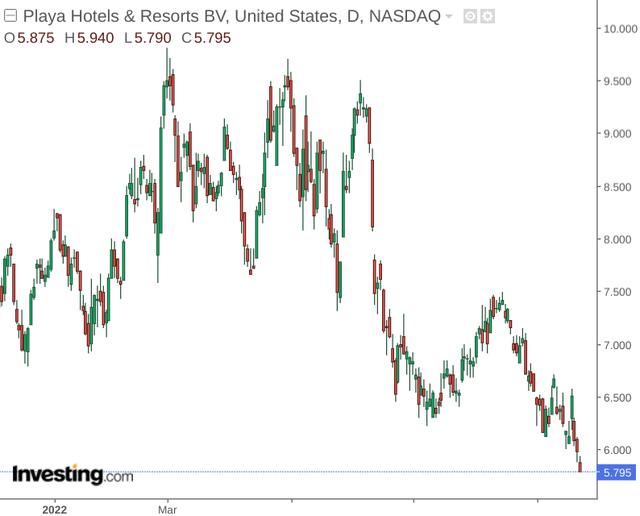

investing.com

Despite my prior assertions, the inventory has been seeing important draw back.

The aim of this text is to guage whether or not Playa Motels & Resorts might see scope for a rebound – notably taking current earnings efficiency under consideration.

Efficiency

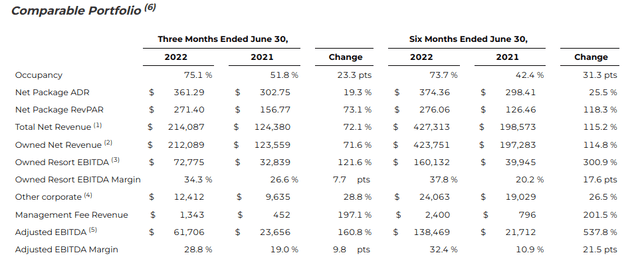

When wanting on the firm’s comparable portfolio efficiency over the newest quarter (which excludes the sale of the Capri Resort and Goals Puerto Aventuras), we are able to see that each RevPAR and adjusted EBITDA are up strongly on that of final yr – each on a 3 -month and six-month ended foundation:

Playa Motels & Resorts NV Experiences Second Quarter 2022 Outcomes

Furthermore, the corporate noticed an enchancment in its ratio of money to complete liabilities:

| December 2021 | June 2022 | |

| Money and money equivalents | 270.088 | 348,797 |

| Present liabilities | 1,426,742 | 1,386,747 |

| Money to complete liabilities ratio | 0.19 | 0.25 |

Supply: Figures ($ in hundreds) sourced from Playa Motels & Resorts NV Second Quarter 2022 Outcomes. Money to complete liabilities ratio calculated by creator.

From this standpoint, there does seem like considerably of a disconnect between firm efficiency and the current decline in inventory worth.

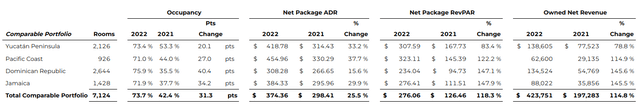

I additionally famous in my final article that the Yucatan Peninsula confirmed the best common RevPAR for the yr 2021 and accounted for just below 30% of complete income in that yr.

Moreover, we are able to see that progress continued strongly into 2022 – with the Yucatan Peninsula remaining the biggest in owned internet income, whereas RevPAR throughout the corporate’s different three geographies confirmed triple-digit share progress.

Playa Motels & Resorts NV Experiences Second Quarter 2022 Outcomes

From this standpoint, Playa Motels & Resorts confirmed a powerful second quarter and the corporate has additionally been capable of elevate its money ranges relative to complete liabilities which can help the corporate in withstanding a possible decline in income throughout the winter months.

Trying Ahead

Going ahead, the inventory would possibly see a decline in what’s at present a risk-averse macroeconomic atmosphere. Playa Motels & Resorts is finally an organization that operates in rising markets and the journey trade is about to see a seasonal drop in demand heading into the winter months.

Consequently, traders could also be cautious and will search for extra proof that Playa Motels & Resorts can face up to the winter months with out seeing too massive a drop in income or having to incur additional debt to fund operations.

The corporate did handle to scale back its debt load from $944.8 million in December 2021 to $915.4 million in June 2022. Ought to we see additional debt reductions over the subsequent couple of quarters, then this will probably be fairly an encouraging signal because it signifies that the corporate remains to be producing enough income to repay its liabilities.

Playa Motels & Resorts NV Experiences Second Quarter 2022 Outcomes

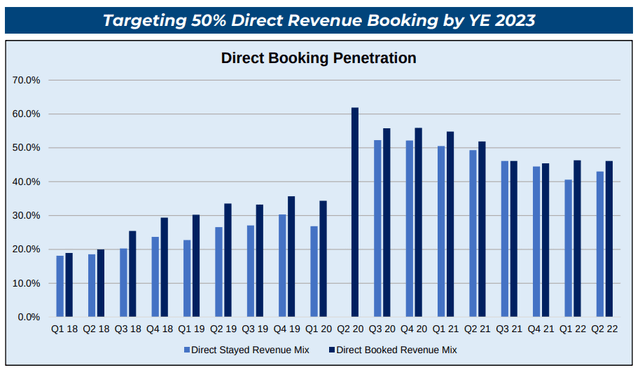

Moreover, Playa Motels & Resorts additionally noticed a big increase in direct bookings after the pandemic – this was notably pushed by demand from america as a higher share of American vacationers sought journey throughout Latin America because of border restrictions throughout Europe on the time.

Playa Motels & Resorts Overview August 2022

Whereas such bookings have seen a gentle decline since then – we are able to see that they nonetheless stay above pre-COVID ranges. Ought to the corporate see direct bookings at 50% by 2023 – then this may also be an encouraging signal as direct bookings decrease the price of buyer acquisition.

In fact, inflation stays a threat for the corporate and may we see an official recession heading into 2023 – then that is anticipated to dent demand for worldwide journey and we might see income progress stall. I anticipate that traders will be predisposed to tread cautiously till the macroeconomic image turns into clearer on this regard.

Conclusion

To conclude, Playa Motels & Resorts has seen a powerful earlier quarter. Nevertheless, the inventory seems to be declining as a result of results of potential inflation on journey. Whereas I take the view that the inventory would possibly see some draw back forward – the inventory might see a big rebound subsequent yr if gross sales and bookings stay resilient.

Further disclosure: This text is written on an “as is” foundation and with out guarantee. The content material represents my opinion solely and under no circumstances constitutes skilled funding recommendation. It’s the accountability of the reader to conduct their due diligence and search funding recommendation from a licensed skilled earlier than making any funding selections. The creator disclaims all legal responsibility for any actions taken primarily based on the data contained on this article.